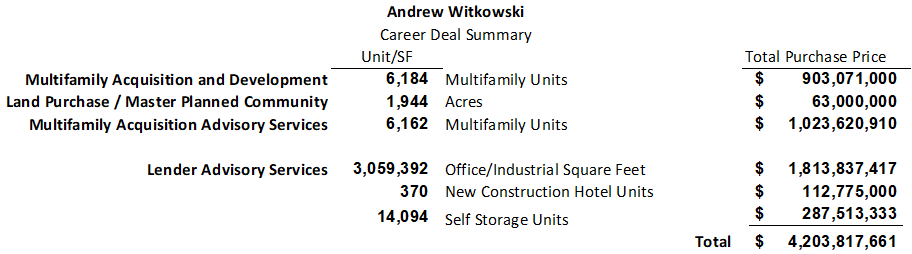

I have over 25 years of experience in multifamily real estate and I’m a versatile executive with strategic vision, analytical skills, and negotiation expertise. I am adept at sourcing and acquiring profitable investment opportunities, managing complex transactions, partnerships, and contracts, and delivering value for clients and partners. I’ve enjoyed investing in rising markets and navigating turbulent downturns. I am always learning and improving myself through experience. My investing experience includes corporate, pension fund, and private investing and asset management. I’ve built or acquired over 6,000 multifamily units, acquired nearly 2,000 acres of land, advised clients on an additional 6,000+ multifamily units, as well as advised various lenders on a career total amount of deals exceeding $4.2 billion of assets.

Recently, I founded a real estate investment firm that specializes in single- and multi-family investments, where I identify, evaluate, and execute deals that align with investor’s objectives while building and maintaining relationships with key stakeholders.

Investment & asset management

Real estate investing is not a process of avoiding risk, but rather of intelligently minimizing risk to achieve optimal returns. Any assessment of the financial performance of a real estate investment must be based on a firm understanding of the realities of the property, its market, and its competitive environment.

Strategic visioning

I believe that while real estate is a financial asset, it is first and foremost an operating asset. I draw on my expertise in the fields of investment, finance, property operations, and urban growth and planning to stay ahead of market conditions and industry trends in order to achieve superior risk-adjusted returns.

Negotiation

Contract negotiation is my bread and butter. With my expertise and experience, I have a knack for finding common ground and striking deals to benefit all parties involved. Whether it’s crafting win-win agreements or resolving disputes, I am the go-to person for getting deals done.

For more information, enter your email address and I will promptly respond.